There’s a reason why so many people fail at managing their finances. That’s because they don’t know where to start.

Well, learning the art of tracking your expenses is definitely something you should consider if you’re looking to upgrade your financial management skills.

But exactly how is it possible to track all your expenses when you have numerous of them in a single day and it’s difficult to keep track.

Stay tuned because we are about to tell you the 3 steps easy process to track your expenses and take charge of your finances.

- Create a budget

Here’s something that no one likes to do- creating a budget. Isn’t that thing supposed to be boring?

Well, it might be boring but it is one of the essential tasks for tracking your expenses.

Create a monthly plan for your money, whether it’s spending, savings, or investments. Having a solid plan for your money each month will help you reach your goals without actually losing your mind.

The first few months might not come up to your expectations but this will help you monitor your spending behavior because we tend to spend much more on certain categories than we think.

- Track every penny

Here comes the real part. There isn’t really a shortcut to tracking your expenses. In order to track and monitor your expenses, you need to consistently record them somewhere so that nothing slips out of your mind.

You can use pen and paper to write down all your expenses and then log them into a spreadsheet so that you have all your data organized.

But that might sound impossible to practice if you’re living a busy life. And that’s where expense tracking apps come to your rescue.

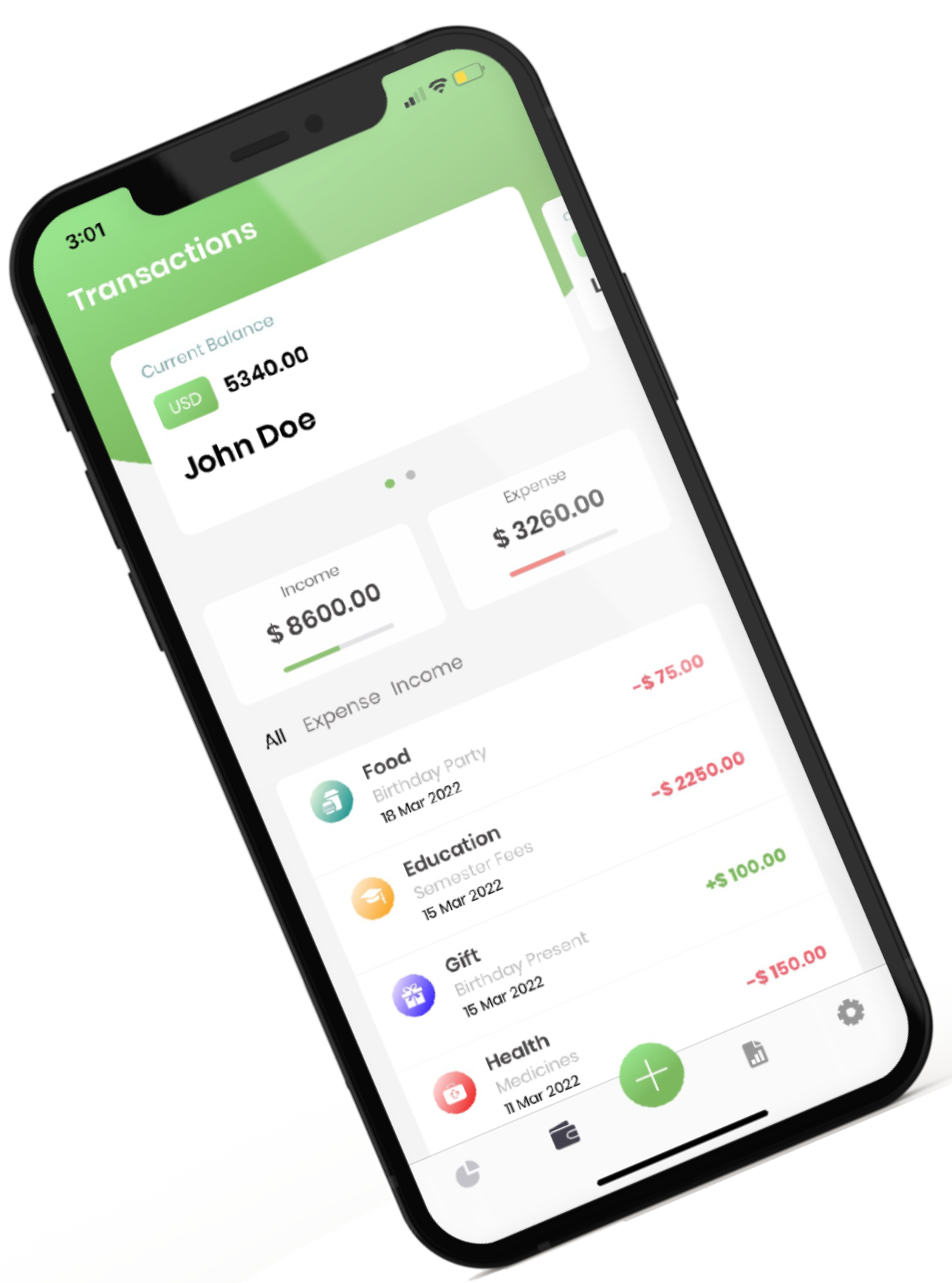

You can use the CashFlow app to make expense tracking a delight for you. It helps you track down all your expenses and categorize them so that you know every minute detail. This step will eventually ease the analysis process for yo.

You don’t need the internet to log in your expenses as it also allows you to work offline and you can easily export your data to drive/iCloud.

- Regular check-ins

Once you’ve figured out your budgeting and expense tracking schedule, it is almost mandatory to set regular check-ins to see how you’re performing.

This step might sound very calculative but it immensely helps you in figuring out your course for the remaining part of the month.

In case you’ve overspent on dinner takeouts for the first week, you can cut down your expenses for the next 3 weeks to balance out your monthly budget.

It is advisable to either set these check-ins once a week or twice every month in order to manage your expenses better.

If you are serious about being financially responsible then tracking your expenses is the first step toward this amazing and liberating journey.

Following this ritual of tracking your expenses will give you a greater sense of responsibility toward your money by helping you learn how to allocate funds to important things and cut down on unnecessary expenditures.