Financial health is something that’s often overlooked by most of us.

One of the most essential parts of maintaining good financial health is efficient management of your finances.

So if you’re someone who finds it hard to keep track of your expenses and are living from paycheck to paycheck, here are 7 simple ways in which you can manage your money better.

-

Set up a budget

The first step to managing your finances better is by working on a monthly budget in order to allocate your spending into the right categories.

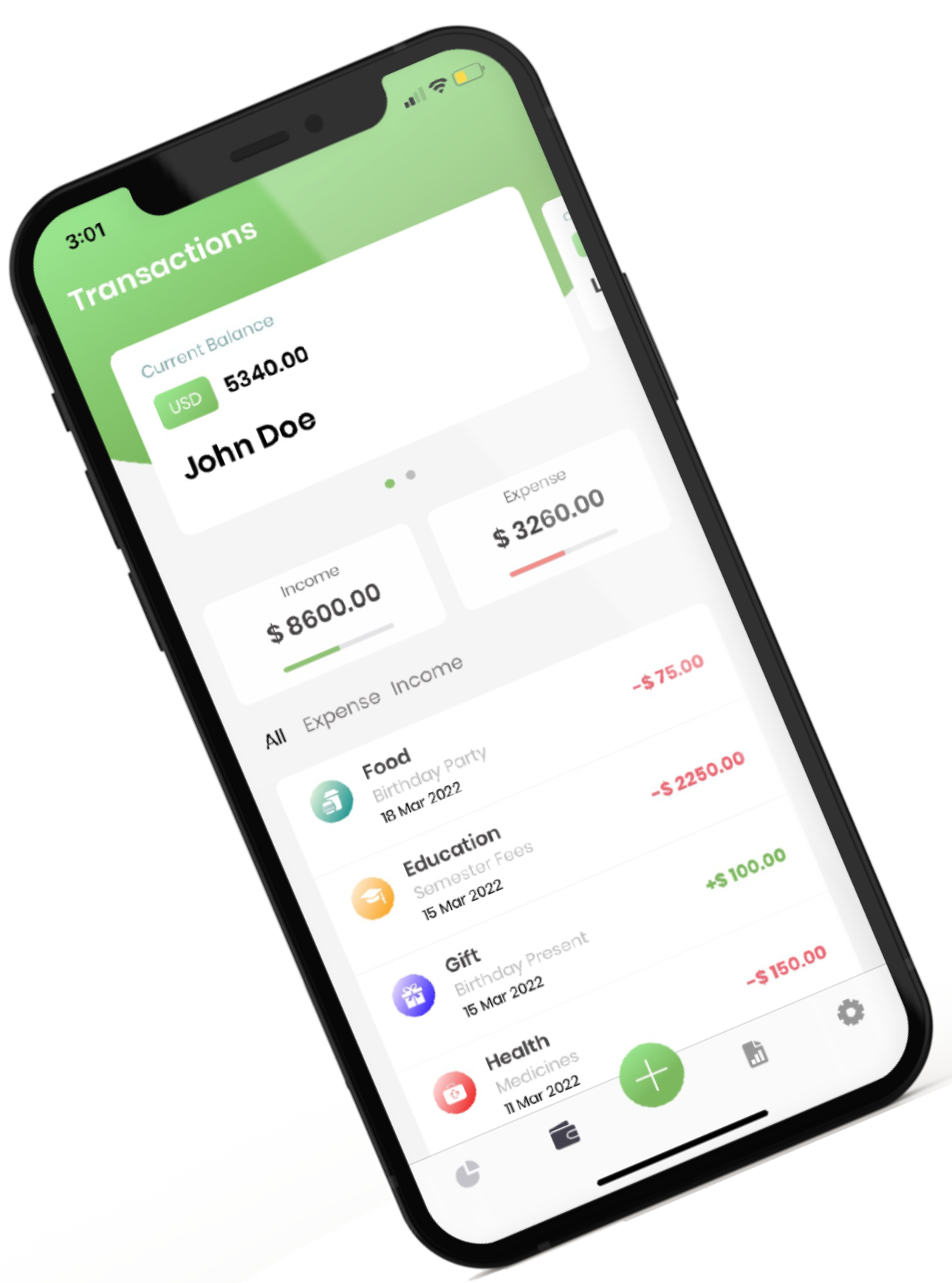

CashFlow Finance Manager can help you ease out this often boring but essential step towards financial stability. You can easily manage your budget on a weekly, monthly, or yearly basis through the app.

-

Track your spendings

In order to save yourself from overspending unnecessarily, you need to start tracking your spending.

Categorize your spending so that you can easily identify the areas where you’re unknowingly spending more than your budget allows.

CashFlow is an easy and accessible way to track your spending and manage your finances more efficiently.

-

Allocate savings first

Splurging on yourself is good but you need to have a solid savings plan working for you.

Decide on how much of your salary will go into your savings and then move forward with managing your monthly expenses.

Savings is a great way to overcome a crisis or for times when you’re looking to make a big purchase like a house or a car.

-

Set up financial goals

One of the most crucial parts of financial growth is setting up goals for yourself.

Think about the things that you wish to achieve financially like saving to travel or going debt-free and prepare a plan for how you will achieve them and how long will it take.

A clear plan will help you stay motivated toward your goals.

-

Debt Payments

With all the savings and financial goals in line, you cannot undermine the importance of paying your debts.

If you have existing debts then you need to accommodate debt repayments into your financial plans because delaying them for long periods of time can get you in trouble and financial instability.

-

Watch your Credit

Using a credit card is a good thing as it gives you an upper hand with a good credit score but overusing it can have some serious implications on your financial health.

So make sure that you’re not overspending and paying your bills on time in order to avoid debt.

-

Hone your craft

And at last, relax and keep practicing. Managing your finances is not at all easy especially if you’re just starting out.

The idea of tracking your spending, setting a budget, and savings might sound overwhelming at first but you don’t have to tackle them all at once.

With little and consistent efforts you’ll keep improving at managing your finances better and before you even know it’ll be a piece of cake.